Business

Coinsurance May Save You: Definition & Real Life Examples

Explains the coinsurance clause, a critical component in property and casualty insurance policies, outlining its function, benefits, and potential penalties for underinsured assets. An essential read for policyholders seeking to optimize their coverage and avoid financial pitfalls.

Coinsurance is one of the most consequential yet misunderstood aspects of commercial property insurance.

In a nutshell, coinsurance is a clause in almost every commercial property insurance policy that requires property owners to cover the full value of their building.

But there is a lot more nuance to it than that. What happens if a building that received an inaccurate appraisal is destroyed? Who should bear the risk, the insurance provider or the policyholder? These are a couple of questions that coinsurance clauses were designed to answer.

Businesses and properties that do not have adequate coinsurance coverage may be subject to coinsurance penalties that reduce the amount of money they can collect from insurers when a loss occurs. This penalty is often proportional to the gap between the property’s coinsurance coverage and the amount of damage a building sustains. For instance, if a coinsurance clause only covers 50% of a property’s value and that property is completely destroyed, then the coinsurance penalty would be 50% (because the policy was not properly established for full coverage which a total loss would require). We will discuss these penalties more in-depth below.

Having a solid understanding of coinsurance is important for any business leader, especially those in places where severe building damage is likely such as the case of weather or other environmental conditions. It could be the difference maker for a business trying to recover from a total disaster.

What is coinsurance in simple terms?

Coinsurance is language in an insurance policy that requires a property owner to essentially share in any property loss that occurs when the proper level of coverage is not secured. Essentially, coinsurance clauses incentivizes property owners to buy insurance equal to the full value of their property. In some cases, insurance providers will offer a discounted policy rate for customers who purchase coinsurance.

Coinsurance payouts are calculated as a percentage of an insured property’s replacement costs, which are oftentimes between 80% and 100% of their building’s value. That means a property valued at $1 million can expect to have a coinsurance limit of at least $800,000.

There are penalties for commercial property owners who only buy insurance coverage for smaller claims that do not result in a building being destroyed. In these cases, coinsurance claims will only pay out a specific percentage of the damage caused depending on how much coverage an insured purchased. This could cause a building owner to receive less money than the damage caused, and force them to pay for the difference out of pocket. Here is how that works.

What does property coinsurance penalize?

Coinsurance penalties prevent a property owner from recovering an amount equal to the damage that an insured building receives. These penalties kick in when a property owner tries to settle a claim for damage on a property with their insurance company, and the insurance coverage was not a high enough percentage of the building’s value.

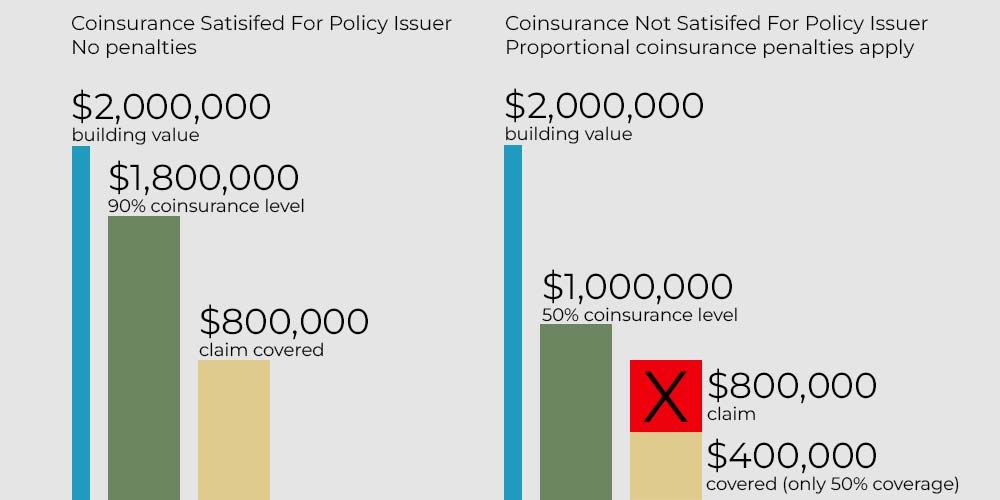

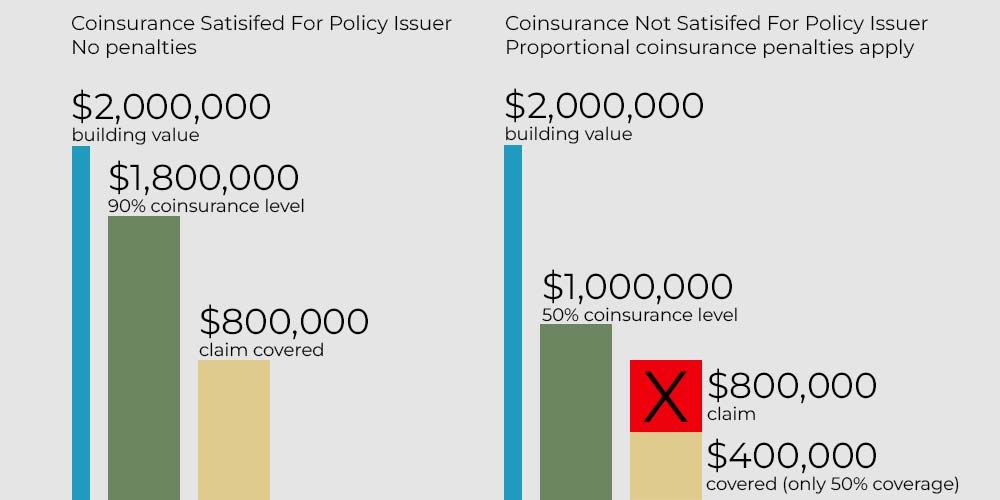

Here’s how it works in practice. Let’s assume you own a $2,000,000 building that meets your policy’s coinsurance level, and the coinsurance clause covers 90% of the building’s value ($1,800,000). One day, you arrive to find the building suffered major damage and needed around $800,000 of repairs. If you have coinsurance, your insurance company would cover the cost of your losses minus your deductible which is how people normally perceive insurance to work.

Now, let us take a look at the same situation, but without the proper coverage according to the coinsurance clause. Let us assume you own the same $2,000,000 building but you only set your coinsurance level 50% below the building’s value which becomes $1 million. In that situation, your insurance provider will only pay 50% of any damage amount incurred which is proportional to the difference between building value ($2,000,000) and coinsurance taken out ($1,000,000). So that $800,000 claim you filed will only result in only approximately $400,000 (50%) being covered (proportionate to the $2,000,000 and $1,000,000 –> 50%), minus your deductible. This is also known as a “coinsurance penalty.”

There is an important caveat regarding the way a building is valued when a property does not have coinsurance coverage. Coinsurance claims base the value on the appraisal that occurs after a damage claim is filed and what it costs to restore the building, not the appraisal that was provided during the underwriting process.

Policyholders can face significant financial risk if they purchase an insurance policy without coinsurance protections. In instances where a property is destroyed, not having coinsurance can reduce the insurance settlement amount a policyholder receives.

Who benefits from coinsurance policies?

Coinsurance policies sound one-sided, but there are benefits for both insurance companies and policyholders.

Policyholders benefit by reducing their financial risk if their insured property is completely destroyed. While these events are rare, coinsurance can help make sure money doesn’t get in the way of recovering from a disaster. Coinsurance policies can also reduce a property’s insurance premium if a property owner chooses to absorb more risk when a loss occurs.

Insurance companies are also protected against losses when they insure a property that has been inaccurately valued. This allows insurance companies to maintain premium and rate equality. Coinsurance can also incentivize property owners to get their property appraised consistently, which can help make sure insurance rates are as accurate as possible.